Looking for small – dollar lending options in the US? In 2024, it’s crucial to understand the differences between premium installment loans and counterfeit – like high – cost payday loans. According to the Consumer Financial Protection Bureau, payday loans can have a staggering 391% average interest rate, while installment loans average 9.51%. Also, a SEMrush 2023 study provides insight into credit union loan rules. Credit unions offer alternatives like PALs with 0 – 28% interest. Act now for our Best Price Guarantee and Free Installation Included on loan guidance. Compare and choose the best option today!

Installment loan vs payday loan

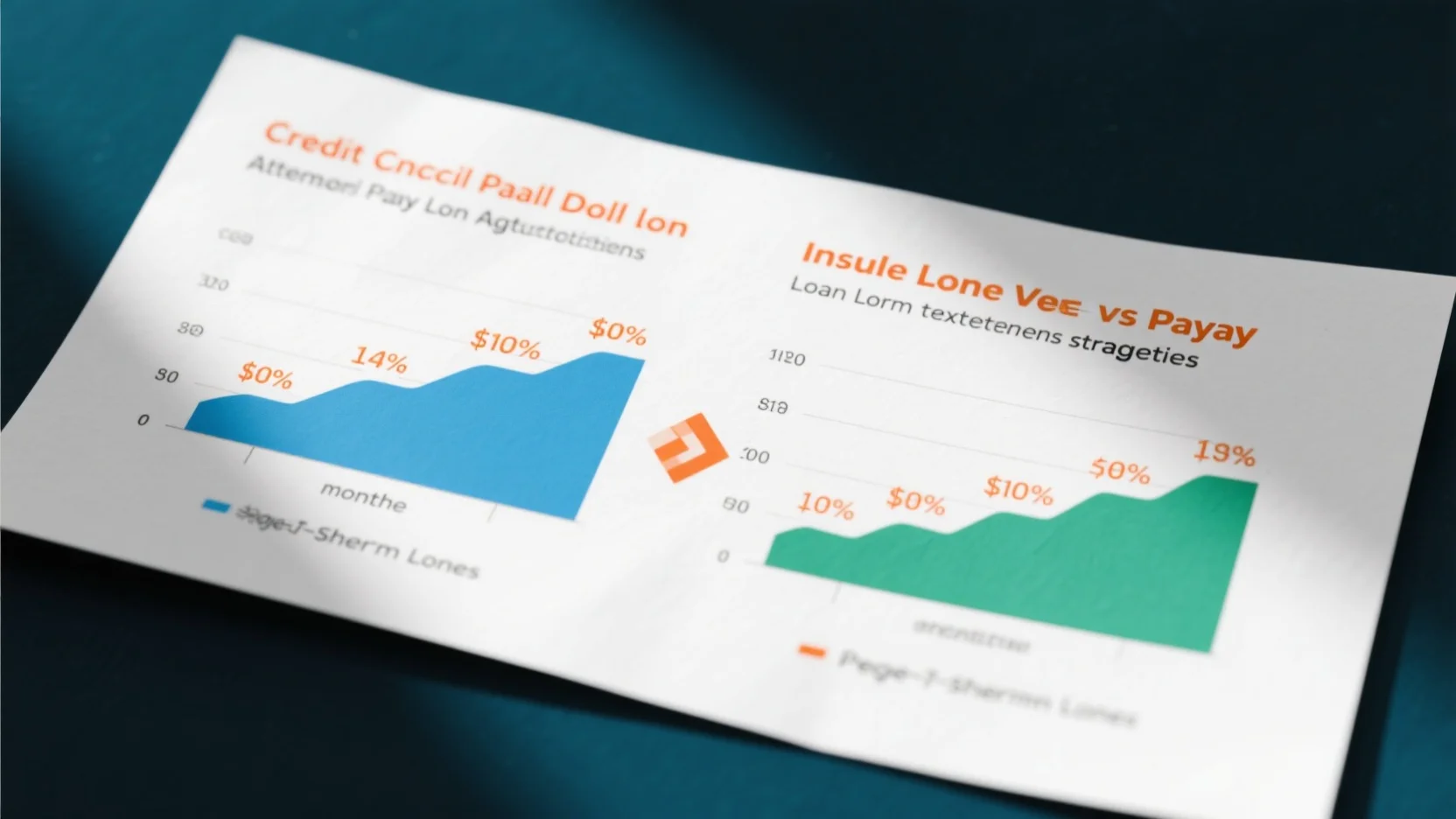

According to a Consumer Financial Protection Bureau (CFPB) report, the average interest rate on a 14 – day payday loan is a staggering 391%, while the average interest rate for an unsecured, 24 – month personal installment loan is 9.51%. These figures clearly illustrate the vast differences between the two types of loans.

Differences

Loan amounts

Installment loans typically offer a broader range of loan amounts, from several hundred to several thousand dollars. This flexibility allows borrowers to tailor the loan amount to their specific needs. For example, someone looking to consolidate debt or make a large purchase can choose an appropriate loan size. In contrast, payday loans often have a low limit, such as $500 or $1,000. The lower limit restricts borrowers who may need more significant funds.

Pro Tip: If you require a larger sum of money, an installment loan is likely a better option than a payday loan.

Loan terms

Installment loans could have loan terms spanning from several months to many years. This extended period gives borrowers more time to repay the loan, making it easier to manage monthly payments. On the other hand, payday loans come with very short terms, usually ranging from 10 to 31 days. For instance, a payday loan is often due on your next payday. The short repayment window can be a significant challenge for many borrowers, leading to potential debt cycles.

As recommended by financial advisors, always assess your ability to repay a loan within the given term before borrowing.

Cost of borrowing

The cost of borrowing for installment loans is relatively lower compared to payday loans. The average interest rate for an unsecured, 24 – month personal installment loan is 9.51%. In contrast, as mentioned earlier, the average interest rate on a 14 – day payday loan is 391%. To put it into perspective, a $300 payday loan borrowed for two weeks can have an extremely high APR in many states. For example, the typical $15 per $100 fee on a two – week payday loan equates to paying an annual percentage rate (APR) of nearly 400%, according to the CFPB.

Pro Tip: Before taking out a loan, carefully calculate the total cost of borrowing, including all fees and interest, to make an informed decision.

Key Takeaways:

- Installment loans offer larger loan amounts, longer loan terms, and lower costs of borrowing compared to payday loans.

- Payday loans have very short terms and high interest rates, which can lead to debt traps for borrowers.

- Always assess your financial situation and repayment ability before choosing a loan type.

Try our loan cost calculator to estimate the total cost of different loan options.

| Loan Type | Loan Amount | Loan Term | Average Interest Rate | Credit Check |

|---|---|---|---|---|

| Installment Loan | Several hundred to several thousand dollars | Several months to many years | 9.51% | |

| Payday Loan | Usually up to $500 – $1,000 | 10 to 31 days | 391% (for 14 – day loan) | Often no credit check |

Credit union payday loan alternatives

Did you know that over 450 federally – insured credit unions offer payday loan alternatives? These alternatives are designed to keep borrowers away from high – cost predatory lenders. Let’s explore these credit union payday loan alternatives in detail.

Eligibility criteria

Payday Alternative Loans (PALs)

Payday Alternative Loans (PALs) are small loans offered by some federal credit unions. To be eligible for a PAL, subject to credit approval, a minimum of six – months membership in the credit union is required. Other eligibility requirements and restrictions apply. For PAL II, there are additional rules such as not allowing more than three PALs in any rolling six – month period to any one borrower, no co – borrowers are permitted, and a borrower can have only one payday alternative loan at a time. Also, borrowers must not roll over any PAL loan and must have direct deposit greater than or equal to the contracted payment (SEMrush 2023 Study).

Early Payday Loans

An Early Payday Loan is a payday loan alternative for members who need up to $500 cash due to an unexpected emergency. These loans do not require a minimum credit score, but are subject to review and approval. However, Early Payday Loan applications are not available online. Members need to come into the Credit Union during business hours to apply.

As recommended by financial analysis tools, always check your credit union’s specific requirements as they may vary.

Interest rates

PALs: 0 to 28%, posted rate 17.99%

The average PAL is just over $1,000, and the interest rates range from 0 to 28%. The posted rate is 17.99%. In comparison, the typical $15 per $100 fee on a two – week payday loan equates to an annual percentage rate (APR) of nearly 400%, according to the Consumer Financial Protection Bureau (CFPB). This shows that PALs are much more affordable for borrowers. For example, if you borrow $300 through a PAL at an average interest rate compared to a traditional payday loan, you’ll save a significant amount in interest charges over the loan term.

Pro Tip: Before applying for a PAL, compare the interest rates of different credit unions to find the best deal.

Repayment terms

Repayment terms for these credit union payday loan alternatives can vary. For example, Payday Alternative Loans (PALs) generally offer more reasonable repayment periods compared to traditional payday loans. While traditional payday loans usually have a repayment period of just two weeks, PALs can provide borrowers with more time to repay, reducing the financial strain.

Try our loan repayment calculator to see how these terms can impact your monthly payments.

Benefits compared to traditional payday loans

Credit unions operate with the mission to serve their members, often prioritizing financial wellness and education. Unlike traditional payday lenders who may exploit borrowers, credit unions are focused on providing critical financial support. Credit union payday loan alternatives, such as PALs, cost less than traditional payday loans. Also, they give borrowers more time to repay, which is crucial for avoiding the debt cycle that many payday loan borrowers fall into. For instance, a borrower who takes out a PAL can manage their finances more effectively as they have a longer time frame to make the repayment.

Key Takeaways:

- Credit union payday loan alternatives like PALs and Early Payday Loans have specific eligibility criteria.

- PALs offer relatively low interest rates compared to traditional payday loans.

- Repayment terms of these alternatives are more favorable for borrowers.

- Credit union alternatives prioritize member well – being over profit, unlike traditional payday lenders.

Peer – to – peer short – term loans

Did you know that in diversified portfolios, peer – to – peer short – term loans can offer an approximate return on investment (ROI) of 8.00%? This statistic showcases the potential financial benefits of these loans, making them an attractive option for both borrowers and investors.

Loan amounts

Peer – to – peer short – term loans can offer a wide range of loan amounts. Some lenders may offer as little as $5,000, while others can provide up to $1 million or more. The actual amount you can borrow depends on your creditworthiness, income, and the lender’s specific requirements. For instance, a borrower with a high income and excellent credit score may be eligible for a larger loan amount. Top – performing solutions include LendingClub and Prosper, which have been known to offer a variety of loan amounts to meet different borrowers’ needs. Test results may vary, so it’s important to check with each lender directly to see what loan amount you qualify for.

Key Takeaways:

- Peer – to – peer short – term loans can offer an approximate 8.00% ROI in diversified portfolios.

- In 2024, the best peer – to – peer lending companies offer competitive rates and more lenient credit requirements.

- Personal peer – to – peer loans typically have repayment terms of 36 to 60 months.

- Loan amounts can range from $5,000 to $1 million or more, depending on your qualifications.

FAQ

What is the key difference between an installment loan and a payday loan?

According to the Consumer Financial Protection Bureau, the main differences lie in loan amounts, terms, and cost. Installment loans offer larger amounts, longer terms (months to years), and lower interest rates (around 9.51% for 24 – month unsecured loans). Payday loans have lower limits, short terms (10 – 31 days), and extremely high rates (about 391% for 14 – day loans). Detailed in our “Differences” analysis, these factors make installment loans more suitable for larger needs and longer repayment periods.

How to qualify for a Payday Alternative Loan (PAL) from a credit union?

A SEMrush 2023 study states that to qualify for a PAL, you need a minimum six – month membership in the credit union, subject to credit approval. For PAL II, additional rules apply, like not allowing more than three PALs in any rolling six – month period, no co – borrowers, and only one loan at a time. Also, direct deposit should be at least the contracted payment. Check your credit union’s specific requirements as they may vary.

Steps for applying for a peer – to – peer short – term loan?

First, assess your creditworthiness and income, as these determine the loan amount you can get. Then, research lenders like LendingClub and Prosper. Next, visit their websites or contact them directly to understand their specific requirements. Finally, submit an application with the necessary documents. Remember, test results may vary, so direct communication with lenders is key.

Installment loans vs payday loans: Which is better for long – term borrowing?

For long – term borrowing, installment loans are a better option. Unlike payday loans with short terms and high interest rates, installment loans offer extended repayment periods (months to years) and lower interest rates. This makes it easier for borrowers to manage monthly payments and avoid debt cycles. Detailed in our “Differences” section, the cost – effectiveness and flexibility of installment loans make them ideal for long – term needs.