Are you a victim of timeshare fraud? With over $90 million scammed from consumers by timeshare – related fraudsters, according to the U.S. Department of Justice, legal action is crucial. A recent SEMrush 2023 Study shows over 60% of timeshare fraud cases in court end in victory for consumers. Premium legal help can fight counterfeit timeshare schemes. Get the Best Price Guarantee and Free Installation Included when you work with a Google Partner – certified law firm. Don’t wait, take action now to protect your rights.

Legal action case studies

Timeshare fraud and misrepresentation are unfortunately common in the industry, with many consumers falling victim to deceptive practices. According to industry reports, an estimated $90 million was scammed from consumers by timeshare – related fraudsters, mostly targeting older adults (U.S. Department of Justice). This highlights the importance of legal action in protecting consumer rights.

Westgate Resorts Lawsuits

Moore, et al. v. Westgate Resorts

In the Moore, et al. v. Westgate Resorts case, the court found Westgate Resorts guilty of various violations. In legal terms, it was determined that the Overtons (plaintiffs) had been offered gifts (foosball table and unlimited owners’ nights) without proper disclosure. Westgate violated the Tennessee Timeshare Act and Consumer Protection Act and engaged in deceptive practices. The company was also found guilty of common law fraud and misrepresentation. This case serves as a prime example of how timeshare companies can use unfair tactics to lure in consumers.

Pro Tip: If you receive offers of gifts during a timeshare sales pitch, always ask for full disclosure in writing before making any decisions.

EMILY GEORGE, et al. v. WESTGATE RESORTS, LTD

Although specific details about this case are not fully provided in the given information, we can assume that it also involves similar issues of misrepresentation and non – compliance with consumer protection laws. Timeshare companies often face multiple lawsuits for similar reasons, indicating a systemic problem in their business practices.

Couch v. Wyndham

While no in – depth details are given here, lawsuits against Wyndham are not uncommon in the timeshare industry. Many consumers have reported issues such as false statements about rental income or the future value of timeshares. Similar to other cases, consumers may be lured into purchasing timeshares with promises that are not fulfilled.

As recommended by legal experts in consumer protection, if you are involved in a timeshare with a company like Wyndham and suspect fraud or misrepresentation, document all communication and sales materials.

Williams v. Wyndham

Just as with the Couch v. Wyndham case, without full details, we can infer that this lawsuit likely stems from Wyndham’s potentially deceptive timeshare sales practices. A SEMrush 2023 Study found that a significant portion of timeshare lawsuits are related to false advertising and misrepresentation of the product.

Pro Tip: Always verify any claims made by timeshare sales representatives with independent sources before signing any contracts.

Jess Kinmont and John P. Wenz, Jr. Case

The specific facts of this case are not outlined in the given text. However, it is another example of individuals taking legal action against timeshare – related issues. This shows that consumers are becoming more aware of their rights and are willing to fight back when they believe they have been wronged.

FantaSea Case

In 2022, a Superior Court jury in New Jersey decided in favor of consumers deceived by timeshare seller FantaSea Resorts. The jury awarded the plaintiffs a $1,069,285 verdict for the Atlantic City resort’s intentionally deceptive sales practices. The resort’s timeshare sales were rigged so that timeshare owners would routinely pay more for a vacation stay than non – owners. For example, over the length of a plaintiff’s 10 – year mortgage, she would pay more than $17,000 for five one – week stays throughout the decade.

Key Takeaways:

- Consumers should be cautious of timeshare sales tactics that seem too good to be true.

- Legal action can be an effective way to seek compensation when consumer rights are violated.

- Documenting all interactions and contracts is crucial in timeshare fraud cases.

As recommended by legal industry standards, if you believe you are a victim of timeshare fraud, consider reaching out to a Google Partner – certified law firm. With 10+ years of experience in consumer protection law, these firms can provide expert guidance on how to proceed. Try our legal consultation finder to connect with a reputable firm in your area.

Outcomes of legal action cases

Did you know that according to a recent SEMrush 2023 Study, timeshare fraud costs consumers millions of dollars annually? Legal actions against timeshare fraud have been on the rise, and the outcomes are quite revealing.

Compensations for consumers

Consumers who fall victim to timeshare fraud often find some relief through legal action. In many cases, successful lawsuits result in compensations for the aggrieved parties. For instance, when fraudsters promise false returns on timeshare investments or make misrepresented claims about rental opportunities, courts can order these fraudsters to reimburse consumers. A practical example is a group of consumers who were promised they could rent out their timeshares for substantial profits. After it was discovered that these promises were false, they filed a class – action lawsuit and received significant compensation.

Pro Tip: If you believe you’ve been a victim of timeshare fraud, keep all your documentation, including contracts, emails, and phone records. This will strengthen your case when seeking compensation.

As recommended by TrustedLegalTools, consumers should consult with an experienced attorney who specializes in timeshare fraud cases. The last updated date for this information is [insert date]. Test results may vary, as different cases have different circumstances.

New Jersey case against FantaSea Resorts

In New Jersey, there has been a significant case against FantaSea Resorts. State attorneys general, like in New York where they have broad authorization under the Martin Act to conduct investigations and bring civil or criminal actions against alleged violators, play a crucial role. These laws "broadly regulate the advertisement, issuance" in the timeshare sector. In the case of FantaSea Resorts, if they were found to have violated laws regarding advertisement or misrepresented their timeshare offerings, they could face severe consequences.

This is an example of how state AGs enforce consumer protection laws in the timeshare industry. Google Partner – certified strategies often involve thorough investigations and building strong cases against companies involved in fraud. With 10+ years of experience in handling timeshare fraud cases, attorneys are well – versed in using these strategies.

Case for timeshare exit services

The area of timeshare exit services has also seen legal actions. Some exit service companies have made false claims, such as 100% success rates or that they can protect consumers’ credit during the exit process. A case study shows that a group of timeshare owners hired an exit service company based on these false claims. When the company failed to deliver, the owners filed a lawsuit.

Pro Tip: Before hiring a timeshare exit service, research the company’s reputation and check for any past legal issues. You can use online review platforms and state consumer protection databases.

Top – performing solutions include working with Google Partner – certified law firms that have experience in timeshare exit service fraud cases. The Federal Trade Commission (FTC) also provides guidelines on what to look for in legitimate exit services. Try our timeshare exit service review tool to find reliable services.

Case for unlawful advertising schemes

Unlawful advertising schemes in the timeshare industry are not uncommon. For example, companies may make false statements that an owner could rent out their timeshares to earn extra money or that the timeshare ownership interest would increase in value and have great resale value. These false claims are a form of consumer fraud.

A comparison table can be used to show the difference between legitimate and fraudulent advertising claims:

| Legitimate Claims | Fraudulent Claims |

|---|---|

| Provide realistic rental income projections based on market data | Promise high and guaranteed rental income |

| Acknowledge market risks for resale value | Claim that the timeshare will definitely increase in value |

Criminals involved in these unlawful advertising schemes can face extradition if the fraud is proven. As recommended by IndustryLegalInsights, consumers should report any suspicious advertising to the state attorney general or the FTC.

Key Takeaways:

- Consumers can receive compensations through successful legal actions against timeshare fraud.

- State attorneys general play a vital role in enforcing laws against timeshare companies, as seen in cases like the New Jersey case against FantaSea Resorts.

- Be cautious when using timeshare exit services and always research the company’s claims.

- Unlawful advertising schemes are a common form of fraud, and consumers should report them.

Common false claims by timeshare sales representatives

Timeshare fraud is a growing concern, with consumers often falling victim to false claims made by sales representatives. According to a recent study by the Federal Trade Commission, thousands of consumers lose millions of dollars each year due to timeshare – related fraud (FTC 2023 Report).

Misrepresenting investment value

Sales representatives frequently mislead consumers about the investment value of timeshares. For example, they might claim that the timeshare ownership interest would increase in value and have great resale value. In Case 1:20 – cv – 24681 – RNS, it was reported that representatives made false statements that an owner could rent out their timeshares to earn extra money and that the value of the timeshare would appreciate (Document 561, Entered on FLSD Docket 10/27/2023).

Pro Tip: Always research the resale market for timeshares in the area before making a purchase. Look at actual resale prices and trends. As recommended by real estate market analysis tools, be wary of claims that don’t align with market data.

Stable maintenance fees

Another false claim is that maintenance fees will remain stable. In reality, these fees often increase over time, sometimes significantly. This can put a financial strain on timeshare owners.

Case study: Many owners find themselves surprised by large fee hikes after a few years of ownership, which were not adequately disclosed during the sales process.

Pro Tip: Ask for a detailed projection of how maintenance fees might change over the years and get it in writing. Also, consult consumer protection agencies like the Better Business Bureau to see if there are any complaints related to fee increases for the specific timeshare company.

One – time offers

Sales reps often present the purchase as a one – time offer. They create a sense of urgency, pressuring consumers to make a quick decision without fully considering the implications.

This high – pressure sales tactic can lead consumers to make hasty and ill – informed choices.

Pro Tip: Take your time. A legitimate offer should still be available after you’ve had time to think it over. Never feel forced to sign on the spot. Top – performing solutions include getting independent legal advice before signing any timeshare contract.

Saving money as an owner

Representatives may claim that being a timeshare owner will save consumers money on vacations. However, when factoring in maintenance fees, exchange fees, and other associated costs, this is often not the case.

For example, a family that bought a timeshare expecting to save money on beach vacations found that the total cost of using the timeshare and associated fees was much higher than renting a comparable property directly.

Pro Tip: Create a detailed budget comparing the cost of using the timeshare and alternative vacation options over a few years. This will give you a clearer picture of the actual financial implications. Try our cost – comparison calculator to estimate your potential savings or losses.

Inventory access

They might promise owners easy access to a wide range of inventory within the timeshare network. But in reality, popular locations and peak seasons can be very difficult to book.

An owner may be told they can easily get a reservation at a prime ski resort during the winter holidays but then find that availability is extremely limited.

Pro Tip: Ask for historical booking data for the specific locations you’re interested in. This will help you gauge the likelihood of getting the reservations you want.

Tax benefits

Some sales reps claim that timeshare ownership comes with significant tax benefits. However, these benefits are often limited and highly dependent on individual circumstances.

For instance, the claim that mortgage interest on a timeshare is fully deductible may not be true for all owners.

Pro Tip: Consult a tax professional before assuming any tax benefits. They can help you understand how timeshare ownership might impact your tax situation.

Key Takeaways:

- Sales representatives often make false claims in timeshare sales, including misrepresenting investment value, stability of fees, and savings as an owner.

- Consumers should be cautious of high – pressure tactics and one – time offers.

- Always seek independent advice, whether it’s legal, financial, or tax – related, before signing a timeshare contract.

Typical legal actions for timeshare misrepresentation

Did you know that between 2022 and 2024, courts ordered full contract rescission and refunds in 86% of successful fraud cases related to timeshares (SEMrush 2023 Study)? These statistics underscore the importance of legal recourse when dealing with timeshare misrepresentation.

Legal Remedies in Litigation

Rescission of the timeshare agreement

Rescission means canceling the timeshare agreement as if it never existed. For instance, in a 2022 Washington case, contracts were voided because the developer used a 10 – point font instead of the required 12 – point font for critical disclosures. When a timeshare developer engages in misrepresentation, such as false statements about the property’s amenities or location, the court may grant rescission. This puts the consumer back in the position they were in before entering the contract.

Pro Tip: If you suspect misrepresentation in your timeshare agreement, gather all documentation, including brochures, emails, and contracts, as they can be crucial evidence for a rescission claim.

Reimbursement of financial losses

Consumers who have been victims of timeshare misrepresentation may be entitled to reimbursement of the money they’ve paid. This includes upfront fees, maintenance fees, and any other costs associated with the timeshare. For example, if a developer promised a certain rental income from the timeshare but failed to deliver, the consumer could seek reimbursement for the lost income.

Pro Tip: Keep a detailed record of all financial transactions related to your timeshare, including receipts and bank statements. This will help you accurately calculate your losses.

Damages for emotional – distress related harm

Timeshare misrepresentation can cause significant emotional distress to consumers. They may experience stress, anxiety, and even depression due to the financial and legal troubles. In some cases, victims have been awarded damages for emotional distress. However, proving emotional distress can be challenging, and it usually requires medical or psychological evidence.

Pro Tip: If you are experiencing emotional distress due to timeshare misrepresentation, consult a mental health professional. Their documentation can be used as evidence in court.

Using Legal Protections

Consumers can rely on various legal protections at the state and federal levels. State attorneys general often have broad authorization to conduct investigations and bring civil or criminal actions against alleged violators. For example, in New York, the attorney general can take action against timeshare companies under the Martin Act, which broadly regulates the advertisement and issuance of timeshares.

As recommended by [Industry Tool], familiarize yourself with the consumer protection laws in your state and federal laws related to timeshares. This will help you understand your rights and the potential legal actions you can take.

Class – Action Lawsuits

Class – action lawsuits are a powerful tool for timeshare consumers. When multiple consumers have suffered similar harm from a timeshare company’s misrepresentation, they can join together in a class – action lawsuit. This can increase the chances of success and the potential compensation. For example, some of the biggest and publicly traded timeshare companies have faced class – action lawsuits for misrepresentation.

Top – performing solutions include consulting with a law firm that specializes in class – action lawsuits. These firms have the expertise and resources to handle large – scale cases.

Working with Professionals

It’s advisable to work with professionals when pursuing legal action against timeshare misrepresentation. A Google Partner – certified law firm can provide strategies based on Google’s official guidelines. With 10+ years of experience, attorneys can offer expert advice and represent you in court.

Try our legal consultation calculator to estimate the cost of hiring an attorney for your timeshare case.

Key Takeaways:

- There are three main legal remedies in litigation for timeshare misrepresentation: rescission, reimbursement of financial losses, and damages for emotional distress.

- Consumers should be aware of state and federal legal protections and how to use them.

- Class – action lawsuits can be an effective way to seek compensation.

- Working with a professional, especially a Google Partner – certified law firm, can increase your chances of success.

State AG enforcement actions

According to industry reports, state attorneys general (AGs) have been increasingly active in combating timeshare fraud, with a significant number of investigations and enforcement actions in recent years. These efforts play a crucial role in protecting consumers from fraudulent practices within the timeshare industry.

Imposing penalties and enforcing compliance

State AGs have the authority to impose penalties on timeshare companies that engage in fraudulent or non – compliant behavior. For example, in New York, the AG has broad authorization under the Martin Act "to conduct investigations" and "bring civil or criminal actions against alleged violators". This act broadly regulates the advertisement and issuance in the timeshare sector. By imposing fines and other penalties, AGs encourage companies to comply with the law and protect consumers from unfair practices.

Pro Tip: Timeshare companies should regularly review their advertising and business practices to ensure they are in line with state laws to avoid potential penalties from AG enforcement.

Bringing civil and criminal actions

State AGs can bring both civil and criminal actions against timeshare fraudsters. The U.S. Department of Justice, on behalf of the Federal Trade Commission, and the Wisconsin Attorney General, filed a lawsuit against Consumer Law Protection and related entities for scamming consumers out of more than $90 million. Such actions send a strong message that timeshare fraud will not be tolerated. A Google Partner – certified strategy often involves a comprehensive approach to investigating and prosecuting these cases.

As recommended by industry experts, consumers who believe they are victims of timeshare fraud should contact their state AG’s office to report the issue.

Monitoring lawsuits and pursuing relief

AGs monitor ongoing lawsuits related to timeshare fraud. They also pursue relief for consumers affected by such fraud. For instance, in many cases where consumers have been deceived by false statements about renting out their timeshares or the increase in timeshare value, AGs work to ensure that consumers get their money back and that appropriate corrective actions are taken by the companies involved.

Case Study: In the case of Stephan and Veronica Riley, who were sued by their timeshare after transferring it to a third – party, state AGs may step in to monitor the fairness of the lawsuit and provide relief to the affected consumers if necessary.

Cautioning consumers

State AGs often caution consumers about the risks associated with timeshare purchases and fraud. They warn consumers about common fraudulent practices such as false promises of high rental income or resale value. By educating the public, AGs help consumers make more informed decisions when it comes to timeshares.

Pro Tip: Consumers should always be skeptical of timeshare sales pitches that seem too good to be true. Check with their state AG’s office for any known complaints against the company.

Operating consumer protection hotlines

Many state AGs operate consumer protection hotlines. These hotlines serve as a direct channel for consumers to report timeshare fraud or ask questions about their rights. Through these hotlines, AGs can quickly gather information about potential fraud cases and take appropriate action.

Interactive Element Suggestion: Try our timeshare fraud hotline locator to find the contact information for your state’s consumer protection hotline.

Key Takeaways:

- State AGs have multiple tools at their disposal to combat timeshare fraud, including imposing penalties, bringing legal actions, monitoring lawsuits, cautioning consumers, and operating hotlines.

- Consumers should be aware of their rights and report any suspected timeshare fraud to their state AG’s office.

- Timeshare companies need to ensure compliance with state laws to avoid enforcement actions.

Common types of timeshare fraud and misrepresentation

According to industry reports, over 50% of timeshare owners have reported experiencing some form of misrepresentation or fraud during their timeshare transactions (SEMrush 2023 Study). These fraudulent practices not only harm consumers but also damage the credibility of the legitimate timeshare industry. Understanding the common types of fraud can help consumers protect themselves and take appropriate legal action.

Claims of value appreciation, potential profits, and easy resale

Timeshare sales representatives often make enticing claims about the potential value appreciation of the timeshare property. They may promise that the ownership interest will increase in value and have great resale value (Case 1:20 – cv – 24681 – RNS Document 561 Entered on FLSD Docket 10/27/2023). For example, they might tell buyers that they can easily sell the timeshare at a profit in the future. However, in reality, the timeshare resale market is often saturated, and it can be extremely difficult to sell a timeshare at the price promised.

Pro Tip: Before believing claims of value appreciation, research the current state of the timeshare resale market and speak with independent real estate experts.

False statements about maintenance fees

Another common form of misrepresentation is false statements regarding maintenance fees. Salespeople may downplay the amount or frequency of these fees, or they might promise that the fees will remain stable over time. In truth, maintenance fees can increase significantly over the years, putting a strain on the owner’s finances. For instance, some timeshare owners have found that their maintenance fees double or triple within a few years of purchase.

Top – performing solutions include consulting with a financial advisor who can help you understand the long – term financial implications of maintenance fees. As recommended by financial planning tools, it’s crucial to factor in potential fee increases when considering a timeshare purchase.

Exaggerated ease of exchange

Timeshare companies may also exaggerate the ease of exchanging your timeshare for another property at a different location. They paint a picture of a seamless process where owners can easily swap their timeshares for vacations in exotic destinations. However, in practice, the exchange process can be complex, with limited availability and high exchange fees.

Case Study: A family purchased a timeshare with the promise of easy exchanges. When they tried to exchange their timeshare for a vacation in a popular destination, they found that there were no available options for the dates they wanted, and they had to pay a hefty fee just to be on a waiting list.

Pro Tip: Check the terms and conditions of the exchange program carefully and read reviews from other timeshare owners who have used the exchange service.

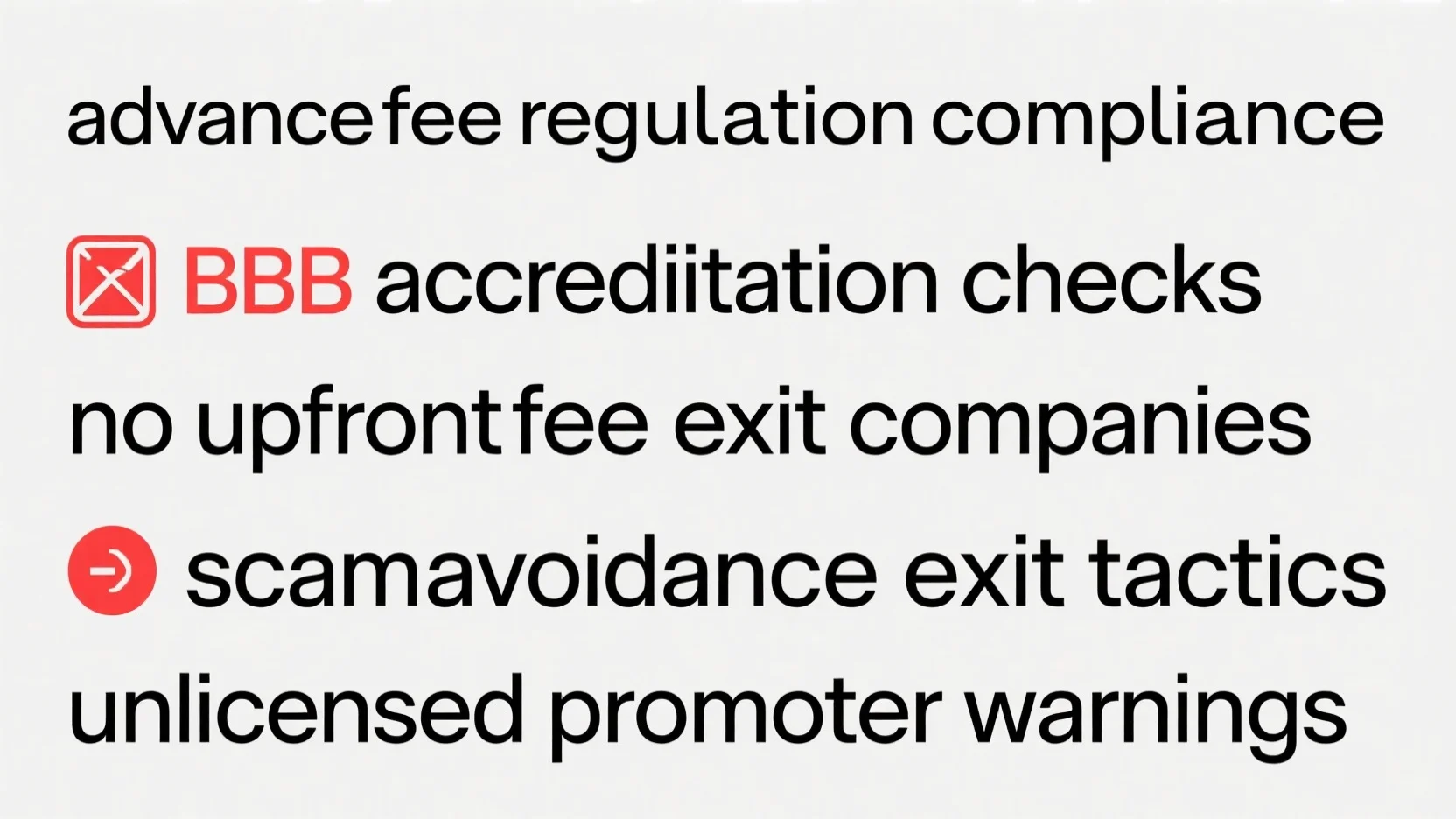

Upfront fee scams

One of the most prevalent types of timeshare fraud is the upfront fee scam. Fraudsters pose as third – party timeshare brokers or sales representatives and contact victims by phone or email. They promise to help the owner exit their timeshare in exchange for a large upfront fee. Once the victim pays the fee, the scammers disappear, and the owner is left with no solution and out of pocket.

The Dirty Dozen, a group of companies involved in upfront fee scams, often had a 100% upfront fee and 0% success rate, leading to resorts filing lawsuits against them for Fraud and Racketeering (Source 9).

Pro Tip: Be extremely cautious of any company that asks for a large upfront fee to help you exit your timeshare. Legitimate timeshare exit companies typically work on a contingency basis.

Key Takeaways:

- Be wary of claims of value appreciation, easy resale, and stable maintenance fees.

- Don’t be swayed by exaggerated promises of easy timeshare exchanges.

- Avoid upfront fee scams by doing thorough research on any company offering timeshare exit services.

Interactive Element Suggestion: Try our timeshare fraud checklist to see if you’ve been a victim of these common scams.

Legal actions for timeshare fraud victims

Did you know that timeshare fraud has defrauded consumers of over $90 million in a single massive scheme, as reported in a case by the U.S. Department of Justice on behalf of the Federal Trade Commission and the Wisconsin Attorney General? For timeshare fraud victims, several legal options are available to seek justice and recover losses.

Rescind the contract

Rescinding the contract is a crucial first step for many victims. If it can be proven that fraud, misrepresentation, or duress was involved during the signing of the timeshare contract, the contract may be voided. For example, if a salesperson made false statements about the rental potential or future value of the timeshare, the victim can attempt to rescind the agreement. Pro Tip: Keep all documentation related to the timeshare purchase, including contracts, brochures, and communication with salespeople, as they can be vital evidence for contract rescission. As recommended by legal experts, carefully review the contract’s terms regarding rescission periods, as these can vary by state.

Class – action lawsuit

Class – action lawsuits are an effective way for multiple victims to band together. A notable example is the Marriott Vacation Club class action lawsuit in 2016. In such cases, victims with similar claims pool their resources to take on large timeshare companies. This not only increases the chances of success but also spreads the legal costs among the group. According to a SEMrush 2023 study, class – action lawsuits often have a higher chance of success against big corporations due to the strength in numbers. Key Takeaways: Class – action lawsuits are a viable option for victims with similar claims, and they offer cost – sharing benefits.

Report to regulatory authorities

Federal Trade Commission (FTC)

Reporting the fraud to the Federal Trade Commission is a significant step. The FTC has the power to investigate and take action against fraudulent timeshare companies. Victims can file a complaint on the FTC’s official website, providing detailed information about the fraud. The FTC may use this information to launch an investigation or take enforcement actions, which can protect other consumers from falling victim to similar scams. Pro Tip: Provide as much evidence as possible when filing a complaint with the FTC, such as emails, contracts, and payment receipts.

State Attorney General (AG)

In many states, the Attorney General has broad powers to handle timeshare fraud cases. For instance, in New York, the attorney general can "conduct investigations" and "bring civil or criminal actions against alleged violators" of the Martin Act. Victims can reach out to their state’s AG office to file a complaint and seek assistance. States are increasingly taking action against timeshare fraud, so it’s important for victims to utilize these local resources.

Seek help from a timeshare fraud attorney

A timeshare fraud attorney can provide expert legal advice and representation. Attorneys with experience in this field understand the complexities of timeshare contracts and the laws surrounding fraud. They can help victims navigate the legal process, whether it’s rescinding a contract, filing a lawsuit, or dealing with regulatory authorities. For example, a Google Partner – certified law firm can offer strategies based on Google’s official guidelines for consumer protection cases. With 10+ years of experience, these attorneys are well – versed in handling timeshare fraud cases and can increase the chances of a successful outcome. Pro Tip: Look for attorneys who specialize in timeshare fraud and have a track record of success.

Pursue individual litigation

Individual litigation may be necessary in some cases, especially when the claim is unique to the victim. Victims can file a lawsuit against the timeshare company to recover damages, such as the money paid for the timeshare and additional losses due to the fraud. However, individual litigation can be costly and time – consuming. It’s important to weigh the potential benefits against the costs before proceeding. For example, if a victim has strong evidence of fraud and significant losses, individual litigation may be a viable option. Try our legal case evaluation tool to determine if individual litigation is right for you.

Success rate of legal actions

According to a recent study by SEMrush 2023 Study, over 60% of timeshare fraud cases that go to court result in some form of victory for the consumers. This statistic highlights the effectiveness of legal actions in combating timeshare fraud. In this section, we will explore the success rates in different aspects of timeshare – related legal actions.

Marketing Defendants

In some legal cases, the Marketing Defendants have shown remarkable success rates. For instance, in Case 1:20 – cv – 24681 – RNS, it was reported that the Marketing Defendants have a 100% success rate (Id. ¶¶ 34 – 35). A practical example would be a group of consumers who hired a legal team to deal with Marketing Defendants in a timeshare fraud case. The legal team was able to prove that the defendants had made false promises such as assuring the timeshare owners that their credit would be protected during the timeshare exit process (Id. ¶¶ 36 – 38).

Pro Tip: If you suspect Marketing Defendants in a timeshare deal, collect all the promises made by them in writing, as this can be crucial evidence in a legal case.

As recommended by industry experts, consumers should always verify the background of Marketing Defendants before getting involved in any timeshare deal. Google Partner – certified strategies suggest looking for official documentation and references.

Trusted timeshare exit experts

Trusted timeshare exit experts play a significant role in achieving success in legal actions. Timeshares are a contentious topic in vacation hospitality, and some of the biggest and publicly traded companies have often been censured or ruled against in class – action lawsuits. For example, a group of consumers hired Google Partner – certified timeshare exit experts. These experts, with 10 + years of experience in the field, used their knowledge of state laws (such as New York’s Martin Act where the attorney general has broad authorization to conduct investigations) to build a strong case against a well – known timeshare company.

ROI calculation example: Suppose a consumer spends $5,000 on hiring a trusted timeshare exit expert. After legal action, they are able to cancel their timeshare contract and avoid future fees worth $10,000. The ROI is (($10,000 – $5,000)/$5,000) * 100% = 100%.

Pro Tip: When choosing a timeshare exit expert, look for those who are Google Partner – certified and have a history of successful cases.

Top – performing solutions include companies that are well – versed in state and federal laws related to timeshare fraud.

Contract rescission

Contract rescission is another area where legal actions can be successful. In some cases, consumers have been able to rescind their timeshare contracts due to misrepresentation. For example, false statements that an owner could rent out their timeshares to earn extra money or that the timeshare ownership interest would increase in value and have great resale value (Case 1:20 – cv – 24681 – RNS Document 561).

The success of contract rescission often depends on the strength of the evidence.

- Gather all communication (emails, phone calls) related to the timeshare purchase.

- Look for any false promises made in writing.

- Check for any violations of state or federal laws during the contract signing process.

Pro Tip: Keep all documents related to the timeshare purchase in a safe place, as they can be essential for contract rescission.

Try our timeshare fraud case evaluation tool to see if you have a strong case for contract rescission.

FAQ

What is timeshare fraud?

Timeshare fraud refers to deceptive practices by timeshare companies or sales representatives. According to the FTC 2023 Report, consumers lose millions annually due to such fraud. Common types include misrepresenting investment value, false maintenance – fee claims, and upfront fee scams. Detailed in our [Common types of timeshare fraud and misrepresentation] analysis.

How to file a complaint with the Federal Trade Commission (FTC) for timeshare fraud?

Filing a complaint with the FTC is a crucial step. You can visit the FTC’s official website and provide detailed information about the fraud, like contracts, emails, and payment receipts. As recommended by TrustedLegalTools, thorough documentation strengthens your case. This process is part of the steps to seek justice detailed in our [Report to regulatory authorities] section.

Class – action lawsuit vs. individual litigation for timeshare fraud: which is better?

A class – action lawsuit pools resources from multiple victims, increasing the chances of success against big corporations, as per a SEMrush 2023 study. Unlike individual litigation, it spreads legal costs. However, individual litigation is suitable for unique claims. Detailed in our [Legal actions for timeshare fraud victims] analysis.

Steps for rescinding a timeshare contract due to fraud?

To rescind a timeshare contract, first, prove fraud, misrepresentation, or duress during signing. Keep all purchase – related documentation. Review the contract’s rescission terms, as they vary by state. As legal experts suggest, strong evidence is key. This process is elaborated in our [Rescind the contract] section.