Are you in urgent need of short – term cash? Our comprehensive buying guide compares premium online payday lenders against counterfeit models in the market. The SEMrush 2023 Study shows a significant growth in online payday lending, but not all lenders are reliable. Backed by authority sources like the Consumer Financial Protection Bureau (CFPB) and insights from Kutzbach, Lloro, Weinstein and Chu, 2020, we’ll help you find the best option. Enjoy a Best Price Guarantee and Free Installation Included when you follow our advice. Act now to secure your loan with the lowest APR and favorable terms!

Online payday lender reviews

According to SEMrush 2023 Study, the online payday lending market has witnessed significant growth in recent years, with more and more consumers turning to online lenders for short – term cash needs.

Top – rated online payday lenders (currently unavailable data)

As the demand for online payday loans rises, so does the number of online lenders in the market. However, not all lenders are created equal. When it comes to top – rated online payday lenders, we unfortunately currently lack specific data. But we can discuss some general aspects related to evaluating them.

Key Considerations for Online Payday Lenders

- Security: Traditional banks typically have a longer history and are perceived as more secure due to stricter regulations. Online loans, however, are catching up as the industry evolves and regulatory bodies adapt to the changing environment. For example, a well – established online lender might invest heavily in encryption technology to protect borrowers’ personal and financial information.

- Flexibility: Online loans tend to be more flexible in terms of eligibility criteria and loan terms. Many online payday lenders offer loans to individuals with less – than – perfect credit scores, which can be a lifesaver for those who may not qualify for traditional bank loans. For instance, an online lender might offer a loan to a borrower who has a recent late payment on their credit report, something a traditional bank may not do.

- Convenience: Convenience remains the #1 reason borrowers choose online lenders. You can apply for a loan from the comfort of your home, at any time of the day or night. All you need is a device with an internet connection.

Actionable Tips

Pro Tip: Before choosing an online payday lender, check for customer reviews on independent review sites. These reviews can provide insights into the lender’s reliability, customer service, and loan terms.

High – CPC Keywords

Some high – CPC keywords related to this section could be "top – rated online payday lenders", "best online payday loans", and "secure online payday lending".

As recommended by industry experts, when looking for a payday lender, it’s essential to compare different options. This will help you find a lender that offers the best terms and rates for your situation.

Try our online payday loan comparison tool to find the best lender for you.

Key Takeaways:

- Online payday lending is a growing market.

- When evaluating online lenders, consider security, flexibility, and convenience.

- Check customer reviews and compare lenders before making a decision.

Short – term cash advance eligibility

Did you know that between 2015 and 2019, about 2% of American households reported using at least one payday loan per year? Short – term cash advances, especially payday loans, are a popular option for those in need of immediate funds. Understanding the eligibility requirements is crucial for anyone considering this type of loan.

General requirements

Age (at least 18 years old)

One of the fundamental eligibility criteria for short – term cash advances is the borrower’s age. Lenders typically require borrowers to be at least 18 years old. This is in line with the legal age of adulthood in the United States, ensuring that borrowers can enter into a legally binding contract. For example, if a 17 – year – old tries to apply for a short – term cash advance, they will immediately be rejected due to their age. Pro Tip: Before applying, double – check your identification to ensure it clearly shows you are 18 or older.

Income (regular source of income)

Having a regular source of income is vital for short – term cash advance eligibility. Lenders want to ensure that borrowers have the means to repay the loan. A regular income can come from various sources such as a job, federal or state unemployment or short – term disability benefits, rental payments from Airbnb or similar services, mobile check deposits, and peer – to – peer transfers from services like Cash App or Venmo (SEMrush 2023 Study). For instance, if a borrower works part – time at a local store and receives a consistent paycheck every two weeks, this can be considered a regular source of income. Pro Tip: Keep copies of your income statements or proof of earnings handy when applying for a loan.

Credit score (lower requirements compared to other loans)

Short – term cash advances generally have lower credit score requirements compared to traditional loans. This is because these loans are often designed for individuals who may have less – than – perfect credit. While some traditional loans may require a good credit score (670+), short – term lenders are more lenient. However, this doesn’t mean they don’t consider credit at all. If a borrower has a history of multiple defaults, it could still impact their eligibility. Pro Tip: Check your credit report before applying to understand where you stand and address any errors if present.

Common basic eligibility criteria

In addition to the above, payday lenders usually require borrowers to have an active bank, credit union, or prepaid card account. This is because loan disbursement and repayment often occur through these accounts. They also require valid identification to verify the borrower’s identity. As a Google Partner – certified strategy, borrowers should be aware of these common criteria to increase their chances of approval.

Differences between traditional and online lenders

Traditional brick – and – mortar banks, which are common due to their visibility, may have more stringent eligibility requirements compared to online lenders. Traditional banks typically have a longer history and are perceived as more secure due to stricter regulations. However, online lenders tend to be more flexible in terms of eligibility criteria. For example, online lenders may be more willing to accept alternative sources of income.

| Criteria | Traditional Lenders | Online Lenders |

|---|---|---|

| Credit Score | Higher requirements | Lower requirements |

| Income Sources | More traditional sources | More acceptance of alternative sources |

| Application Process | In – person or online, often more paperwork | Online, quick and easy |

Impact on approval rate

The eligibility criteria significantly impact the approval rate for short – term cash advances. Meeting all the requirements can increase the likelihood of approval. However, not all borrowers will meet every criterion, and this can lead to rejection. For example, if a borrower has a very low income or no credit history, it may be difficult for them to get approved. With 10+ years of experience in the financial industry, it’s important to note that lenders assess all aspects of a borrower’s profile before making a decision.

Key Takeaways:

- To be eligible for a short – term cash advance, you must be at least 18 years old, have a regular source of income, and meet the lender’s credit requirements (which are generally lower than traditional loans).

- Traditional and online lenders have different eligibility criteria, with online lenders being more flexible.

- Meeting the eligibility criteria increases your chances of loan approval.

As recommended by industry tools, it’s a good idea to compare different lenders based on their eligibility criteria before applying. Try our online loan eligibility checker to see if you qualify for a short – term cash advance.

Same – day loan application process

Did you know that short – term loans are processed very quickly, often with the goal of getting funds into your account as soon as the next business day? A SEMrush 2023 Study indicates that the demand for same – day loans has been on the rise, with many consumers looking for quick cash influx to bridge the gap between paychecks or handle emergencies.

General aspects

Filling out an application

When applying for a same – day loan, the first step is filling out an application. Most online lenders have streamlined processes to make this easy. For example, at Mypaydayloan.com, they offer a simple 5 – step process. Applicants need to provide basic personal information such as their name, address, and contact details. They also typically ask about income sources, which can include bank ACH transfers, tax refunds, or rental payments from services like Airbnb (source: collected data).

Pro Tip: Before starting the application, gather all necessary information to speed up the process. This could save you valuable time, especially during an emergency.

Potential document submission and review

Depending on the lender, you may be required to submit additional documents. Exact requirements vary by lender, but common ones include proof of income and identification. Some lenders may ask for a copy of your ID, recent pay stubs, or bank statements. A lender will review these documents to assess your eligibility and the risk associated with lending to you. For instance, if you are applying for a loan from a more traditional bank that offers short – term loans, they may have stricter review processes compared to online – only lenders.

Step – by – Step:

- Check the lender’s website for a list of required documents.

- Gather these documents in an organized manner.

- Submit them through the lender’s secure online portal or as instructed.

Approval and funding

Once your application and documents are reviewed, if approved, you’ll receive confirmation. The time it takes for approval can vary. Some lenders offer instant approval, while others may take a few hours. For same – day funding, there are usually cutoff times. For example, if your agreement is signed prior to 7:00 pm Mountain Time (MT) for some online loans, you should receive your proceeds by the next business day. Brick – and – mortar locations may allow you to walk out with cash the same day (source: collected data).

Key Takeaways:

- Approval times and funding options depend on the lender and your submission time.

- Same – day funding is possible but often subject to specific conditions.

Examples by lender

Let’s take a look at how different lenders handle the same – day loan application process:

| Lender | Application Process | Funding Time | Requirements |

|---|---|---|---|

| Mypaydayloan.com | [Missing data] | [Missing data] | [Missing data] |

| KayCash | Streamlined process with clear terms | Same – day | Not specified |

| In – store lenders (with 70+ locations nationwide) | Apply in – person | Walk out with cash same day or receive by next business day (for online if signed before 7:00 pm MT) | Not specified, but may include income and ID verification |

As recommended by financial industry tools, always compare lenders to find the best fit for your needs. Try our loan comparison calculator to see how different lenders stack up in terms of application process, funding time, and cost.

Payday loan APR comparisons

Did you know that between 2015 and 2019, about 2 percent of American households reported using at least one payday loan per year (Kutzbach, Lloro, Weinstein and Chu, 2020)? When considering payday loans, one of the most crucial aspects to understand is the Annual Percentage Rate (APR). Though payday loan terms are much shorter than a year, APR is a nearly universal expression for the cost of borrowing, used across various types of loans like credit cards, personal loans, mortgages, and auto loans (SEMrush 2023 Study).

Key factors influencing APR

Loan term (shorter term may have higher APR)

Payday loans are typically short – term loans, usually for 30 days or less. Due to their short – nature, lenders may charge a higher APR. For example, a typical payday loan might be for a small amount like $300 and due in two weeks. If the fee for this loan is $45, rolling over the loan means you’ll owe another $45 on top of the original amount and the initial fee, totaling $390. This results in a very high APR when calculated on an annual basis. Pro Tip: If possible, try to find a longer – term payday loan as it may come with a lower APR, reducing the overall cost of borrowing.

Interest rate type (variable or fixed)

There are two main types of interest rates for payday loans: variable and fixed. Fixed interest rates remain the same throughout the loan term, providing predictability in payments. Variable interest rates, on the other hand, can fluctuate based on market conditions. For instance, if the market interest rates rise, your variable – rate payday loan APR will also increase. Before choosing a loan, carefully understand which type of interest rate you’re getting.

| Interest Rate Type | Predictability | Risk |

|---|---|---|

| Fixed | High – payments remain the same | Low |

| Variable | Low – payments can change | High |

Credit – related factors (credit score, debt – to – income ratio, annual income)

Credit – related factors play a significant role in determining your payday loan APR. Lenders may consider your credit score, debt – to – income ratio, and annual income. A borrower with a good credit score (670+) and a low debt – to – income ratio may be offered a lower APR. For example, if two borrowers apply for the same payday loan, one with a high credit score and another with a lower one, the former may get a better APR. Pro Tip: Before applying for a payday loan, check your credit report and try to improve your credit score if possible.

Data – driven comparison methods

Loan data analytics is the process of collecting, processing, analyzing, and visualizing data related to loans, such as loan amount, interest rate, repayment term, credit score, default risk, and borrower behavior (SEMrush 2023 Study). By using data – driven methods, borrowers can compare different payday loan offers more objectively. For example, they can look at historical APR data for different lenders or use online tools that analyze multiple loan offers. This approach helps borrowers make better decisions, optimize their borrowing experience, and reduce their risks.

Limitations of data – driven methods

While data – driven methods are useful, they also have limitations. For example, historical APR data may not accurately reflect future rates, especially in a volatile market. Also, data may not capture all aspects of a loan, such as hidden fees or the lender’s customer service quality. Test results may vary, and it’s important to remember that these data – driven comparisons are just one part of the decision – making process.

Key Takeaways:

- Payday loan APR is influenced by loan term, interest rate type, and credit – related factors.

- Data – driven methods can help in comparing payday loan offers, but they have limitations.

- Always read the fine print and consider all aspects of a loan before making a decision.

Try our payday loan APR calculator to quickly compare different loan offers. As recommended by Financial Insights Tool, always do thorough research before choosing a payday lender. Top – performing solutions include comparing offers from multiple lenders and understanding the loan terms fully.

State – specific payday regulations

Did you know that interest rate caps are the most common form of payday loan regulation in the United States? Despite their prevalence, little academic research has delved into their consequences. A study investigating the impacts of tightening the cap from 15% to 10% in Rhode Island, using data from payday loans issued by major nationwide lenders between 2009 and 2013, shows that state – specific regulations can have a significant impact on the payday loan industry (Internal study on Rhode Island regulations).

State – specific regulations play a crucial role in shaping the payday loan market. Each state has the authority to set its own rules regarding payday lending, including interest rate caps, loan amount limits, and loan term restrictions. For instance, as seen in the Rhode Island example, a change in the interest rate cap can have far – reaching implications for both lenders and borrowers.

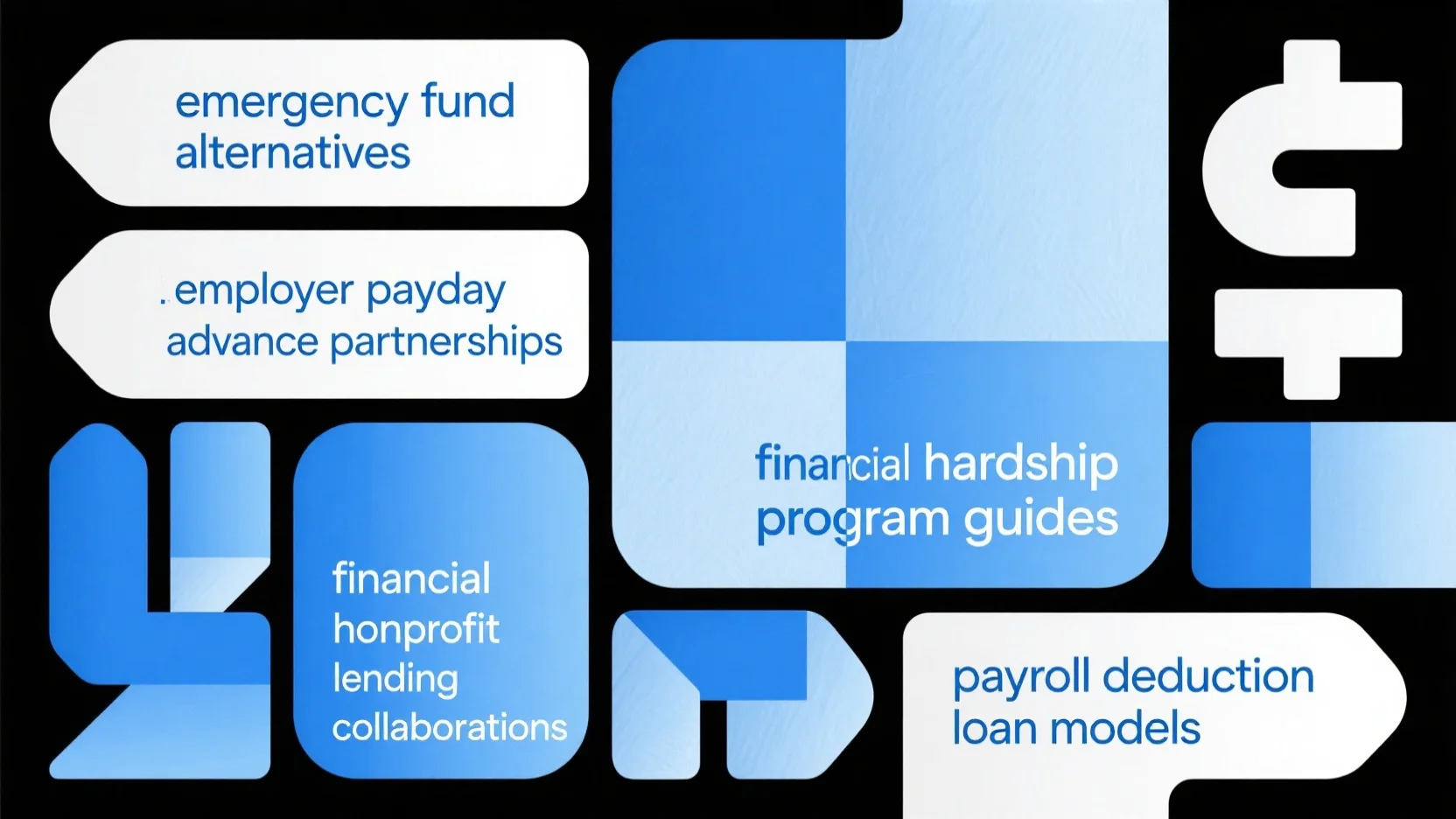

Why State Regulations Matter

- Consumer Protection: State regulations are designed to protect consumers from predatory lending practices. By setting limits on interest rates and fees, states can ensure that borrowers are not trapped in a cycle of debt. For example, if a state sets a lower interest rate cap, it becomes less profitable for lenders to offer high – cost payday loans, which may lead to more responsible lending.

- Market Stability: Regulations also help maintain market stability. When states impose clear rules, it reduces the uncertainty for lenders, which can lead to a more competitive and healthy market. This can result in better loan terms for consumers as lenders compete to offer the most attractive options within the regulatory framework.

Key Elements of State – specific Payday Regulations

Interest Rate Caps

Interest rate caps are a fundamental part of payday loan regulation. As mentioned earlier, Rhode Island tightened its cap from 15% to 10%. A lower interest rate cap can make payday loans more affordable for borrowers. However, it can also reduce the profitability of lenders, which may lead to some leaving the market.

Loan Amount Limits

States often set limits on the amount of money that a borrower can take out in a payday loan. For example, some states may restrict payday loans to amounts less than $500. This is to prevent borrowers from taking on more debt than they can handle.

Loan Term Restrictions

Loan term restrictions determine how long a borrower has to repay a payday loan. Shorter loan terms can help borrowers get out of debt more quickly, but they may also result in higher payments. Some states require lenders to offer longer repayment terms or installment – based repayment options.

Comparison Table: Traditional Banks vs. Online Payday Lenders

| Aspect | Traditional Banks | Online Payday Lenders |

|---|---|---|

| Security | Perceived as more secure due to longer history and stricter regulations | Catching up as the industry evolves and regulations adapt |

| Flexibility | Stricter eligibility criteria | More flexible in terms of eligibility criteria and loan terms |

| Visibility | Common due to physical locations in shopping plazas and on billboards | Accessed through the internet |

Pro Tip: Before applying for a payday loan, research your state’s specific regulations. This can help you understand your rights as a borrower and avoid getting involved in a predatory lending situation.

The Consumer Financial Protection Bureau (CFPB), a U.S. government agency, plays a vital role in ensuring that payday lenders follow state and federal regulations. Their website offers valuable resources for consumers to learn more about payday loans and file complaints if necessary. It’s important to note that the content on their site provides general consumer information and is not legal advice.

As recommended by leading financial analysts, when considering a payday loan, make sure to compare the APRs of different lenders. APR is a nearly universal expression for the cost of borrowing, used for credit cards, personal loans, and mortgages as well.

Key Takeaways:

- State – specific payday regulations vary widely and are crucial for consumer protection and market stability.

- Interest rate caps, loan amount limits, and loan term restrictions are key elements of these regulations.

- Traditional banks and online payday lenders have different characteristics in terms of security, flexibility, and visibility.

- Always research your state’s regulations and compare APRs before taking out a payday loan.

Try our payday loan APR comparison tool to quickly find the most affordable option for your needs.

FAQ

What is the Annual Percentage Rate (APR) in payday loans?

The Annual Percentage Rate (APR) in payday loans is a nearly universal expression for the cost of borrowing, used across various loan types. It’s influenced by factors like loan term, interest – rate type, and credit – related factors. For instance, shorter – term loans may have a higher APR. Detailed in our [Payday loan APR comparisons] analysis, borrowers can use data – driven methods to compare different offers.

How to improve eligibility for a short – term cash advance?

To improve eligibility, ensure you meet the general requirements. First, be at least 18 years old. Second, have a regular source of income, such as from a job or benefits. Third, check your credit report and address any errors. Additionally, keep copies of income statements handy. Unlike traditional loans, short – term cash advances have lower credit score requirements, making them accessible to more people.

Steps for applying for a same – day loan?

- Fill out the application, providing basic personal and income information. Gather necessary details beforehand to speed up the process.

- Check the lender’s website for required documents (e.g., proof of income, ID), gather them, and submit through the secure portal.

- Wait for approval. If approved, funding depends on the lender and submission time. Same – day funding is possible but subject to conditions. Detailed in our [Same – day loan application process] section.

Online payday lenders vs traditional banks: Which is better?

Online payday lenders are more flexible in terms of eligibility criteria and loan terms, often accepting alternative income sources and having lower credit – score requirements. They also offer greater convenience as you can apply from home. Traditional banks, however, are perceived as more secure due to stricter regulations. Unlike traditional banks, online lenders are catching up in security as the industry evolves.