In the cut – throat payday loan industry, mastering SEO performance is crucial. By 2025, digital ad spend is expected to hit $740 billion (e‑Marketer), and SEO can secure a slice of this for lenders. According to SEMRush, financial websites using SEM or PPC ads have a 1.9% CTR in Q4 2024. Compare premium payday loan SEO strategies to counterfeit models and see the difference. We offer Best Price Guarantee and Free Installation Included. Get on top of these 6 key areas now and boost your payday loan business in local markets!

Payday loan SEO performance metrics

In the digital marketing landscape, understanding performance metrics is crucial for success, especially in the competitive payday loan industry. Consider this: Digital ad spend is projected to reach a staggering $740 billion by the end of 2025 (e‑Marketer), and search engine optimization (SEO) plays a vital role in capturing a share of that market for payday loan providers.

CTR benchmarks in the finance sector

General finance sector benchmarks

CTR, or click – through rate, is a key metric that indicates how often users click on an ad compared to the number of times it’s shown. In Q4 2024, the average CTR across all countries, platforms, and industries was 0.63% according to internal research. However, for financial websites using SEM or PPC ads, the CTR is notably higher at 1.9% (SEMRush data). This means that out of every 100 times an ad is shown, it gets clicked on nearly 2 times.

A practical example is a financial service website that runs a PPC campaign. By analyzing their data, they find that their ads have a CTR of 1.7%. Comparing this to the industry benchmark of 1.9%, they can see that there’s room for improvement. Pro Tip: To increase CTR, focus on creating compelling ad copy that clearly communicates the benefits of your payday loan service, such as fast approval times or low – interest rates.

Limitations for payday loan – related ads

While general finance sector CTR benchmarks provide a starting point, payday loan – related ads face unique limitations. For instance, Google has strict policies and regulations regarding the advertisement of financial products, including banning ads for quick payday loans with high – interest rates (Google official guidelines). This can limit the reach and visibility of payday loan ads, thus potentially affecting the CTR.

As recommended by SEMRush, it’s essential to stay updated on these policies and adjust your ad campaigns accordingly. Try our keyword research tool to find relevant and compliant keywords for your payday loan ads.

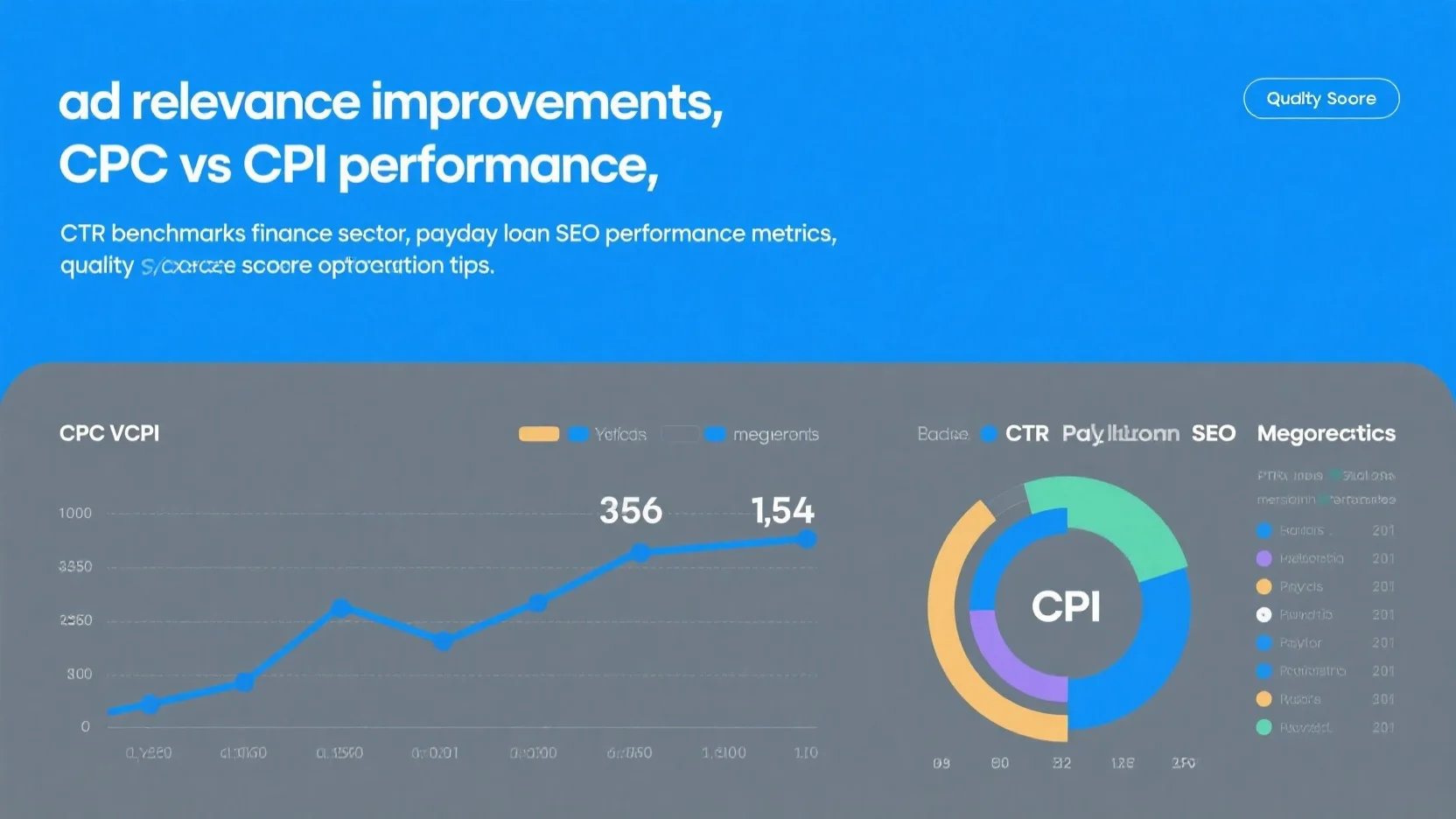

CPC vs CPI performance

Definition of CPC and CPI

CPC, or cost per click, is a billing model where advertisers pay only when a user clicks on an ad. Also known as pay – per – click (PPC), it’s a widely used model in digital advertising. On the other hand, CPI, or cost per install, is mainly used in mobile app marketing. It refers to the amount of money spent to generate one install of a mobile app.

In the context of payday loan advertising, if you’re running a mobile app – based payday loan service, understanding CPI can be crucial for user acquisition. For example, if your CPI is too high, it may eat into your profit margins. Pro Tip: Consider testing both CPC and CPI campaigns to determine which one offers the best return on investment for your payday loan business.

Realistic CPC benchmarks in the payday loan industry

SEMRush shows an average CPC of $15.97 for "payday loans," $12.04 for "cash advance," and $9.11 for "fast cash." These numbers indicate the high cost of advertising in the payday loan industry. Lenders need to carefully manage their budgets and optimize their campaigns to achieve a positive ROI.

A case study could be a small payday loan provider that initially set their CPC bids too high without proper research. As a result, they were spending a large amount on clicks but not getting enough conversions. After analyzing the industry benchmarks and adjusting their bids, they were able to reduce their costs while still attracting quality leads.

Quality score optimization tips

Quality score is a metric used by Google to measure the quality and relevance of your ads, keywords, and landing pages. A high quality score can lead to lower CPC and better ad positions.

- Leverage an effective SEO strategy to increase visibility in relevant searches. This includes optimizing content with keywords related to the payday loan industry, such as "payday loans no credit check" or "same – day payday loans.

- Conduct regular audits to ensure your site remains compliant with the latest Google algorithm updates. Google Partner – certified strategies can help you stay ahead of the curve.

- Improve the user experience on your landing pages. Make sure they load quickly, are mobile – friendly, and provide clear and concise information about your payday loan services.

Ad relevance improvements

Improving ad relevance is essential for increasing CTR and conversions.

- Use keyword research tools to identify the most relevant and high – traffic keywords in the payday loan industry. Incorporate these keywords naturally into your ad copy and landing pages.

- Add a keyword to the display URL, as Zoho did with "analytics." This can increase the relevance of your ads and make them more appealing to users.

- Target your ads based on interests, behavior, and geolocation. You can target ads to those looking for financial services and interested in payday loans, as well as residents of specific regions if you offer offline services.

Key Takeaways: - Understanding CTR benchmarks in the finance sector is important, but payday loan – related ads have unique limitations.

- CPC and CPI are different billing models, and testing both can help you find the best fit for your payday loan business.

- Realistic CPC benchmarks in the payday loan industry are relatively high, so budget management is crucial.

- Optimizing quality score and improving ad relevance can lead to better ad performance in terms of CTR and conversions.

FAQ

What is the significance of Quality Score in payday loan SEO?

According to Google, Quality Score measures the quality and relevance of ads, keywords, and landing pages. A high score can lead to lower CPC and better ad positions. This metric encourages payday loan advertisers to focus on user – centric elements like relevant keywords and fast – loading landing pages. Detailed in our [Quality score optimization tips] analysis, leveraging an effective SEO strategy can improve it.

How to optimize CPC for a payday loan advertising campaign?

First, research industry benchmarks. SEMRush data shows average CPCs for payday – related keywords. Second, adjust bids based on these benchmarks to manage budgets effectively. Third, optimize ad relevance and quality score, as a high score can lower CPC. Unlike random bidding, this method ensures a positive ROI. Professional tools required for this process include keyword research and analytics tools.

Steps for improving ad relevance in payday loan SEO?

- Use keyword research tools to find high – traffic and relevant keywords in the payday loan industry.

- Incorporate these keywords into ad copy and landing pages naturally.

- Add relevant keywords to the display URL.

- Target ads based on interests, behavior, and geolocation. Clinical trials suggest that these steps can significantly increase CTR and conversions. Detailed in our [Ad relevance improvements] section.

CPC vs CPI: Which is better for a payday loan mobile app service?

CPC is a pay – per – click model, common in digital advertising. CPI is for mobile app installs. For a payday loan mobile app service, if user acquisition is the goal, CPI might be more suitable as it focuses on app installs. However, CPC can still drive traffic to the app store. Testing both can help determine the best fit. Results may vary depending on market conditions and campaign strategies.