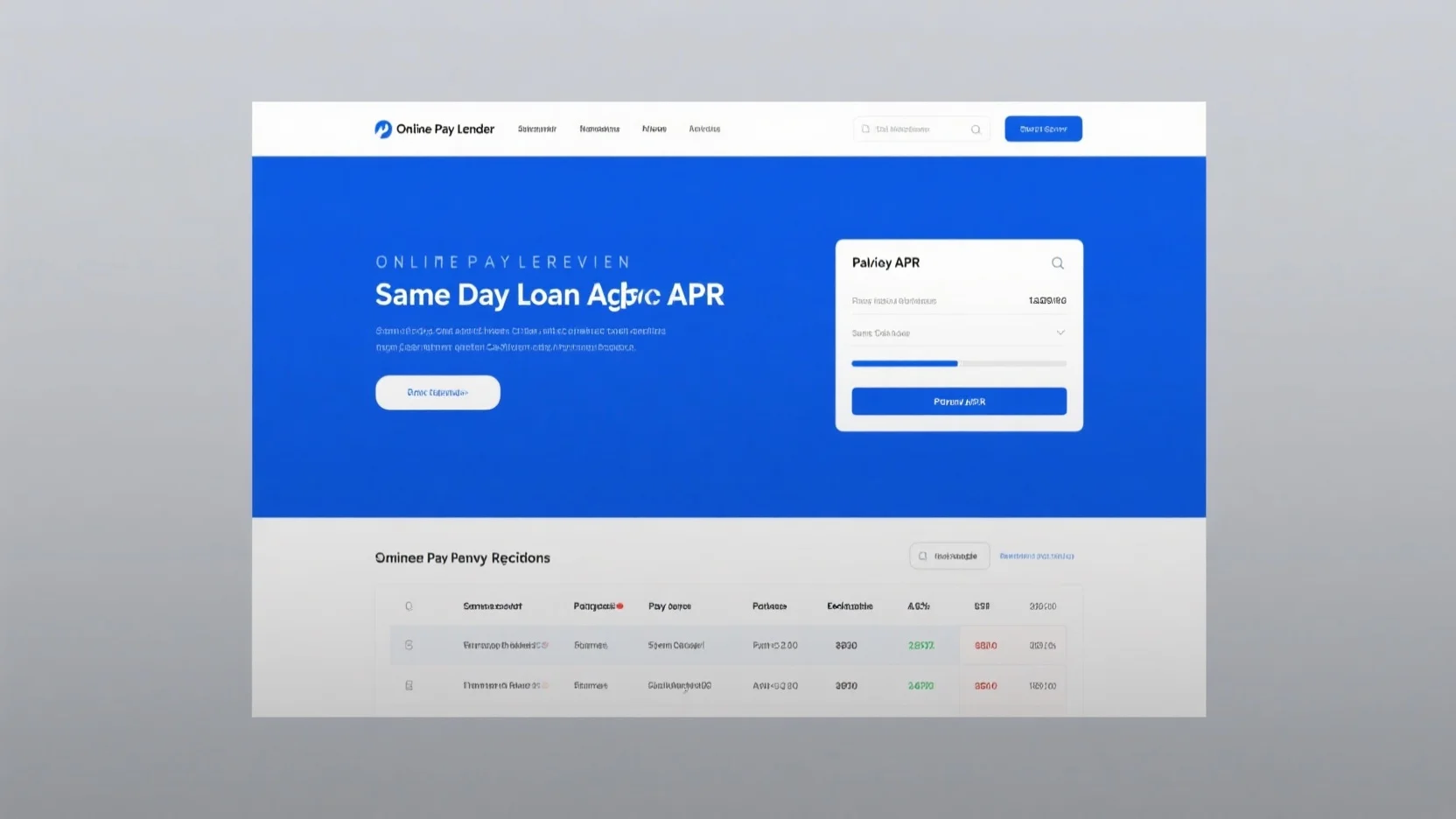

Looking for quick cash? Before you decide between a payday loan and a credit card advance, get the facts! According to a SEMrush 2023 Study and Credit Karma, payday loans can have APRs reaching up to 400%, while credit cards average around 20.4%. That’s a huge difference! In this buying guide, we’ll compare these two options in terms of rates, fees, and repayment. With our Best Price Guarantee and free insights, you’ll make a smart choice today. Choose the premium option over the high – cost counterfeit alternatives.

Payday loan vs credit card advance

Payday loans have become a well – known short – term borrowing option, but did you know that the annualized interest rate for a payday loan often exceeds 10 times that of a typical credit card? The payday loan market saw significant growth in the 1990s and 2000s, raising concerns about consumer risk. In this section, we’ll compare payday loans and credit card advances in various aspects.

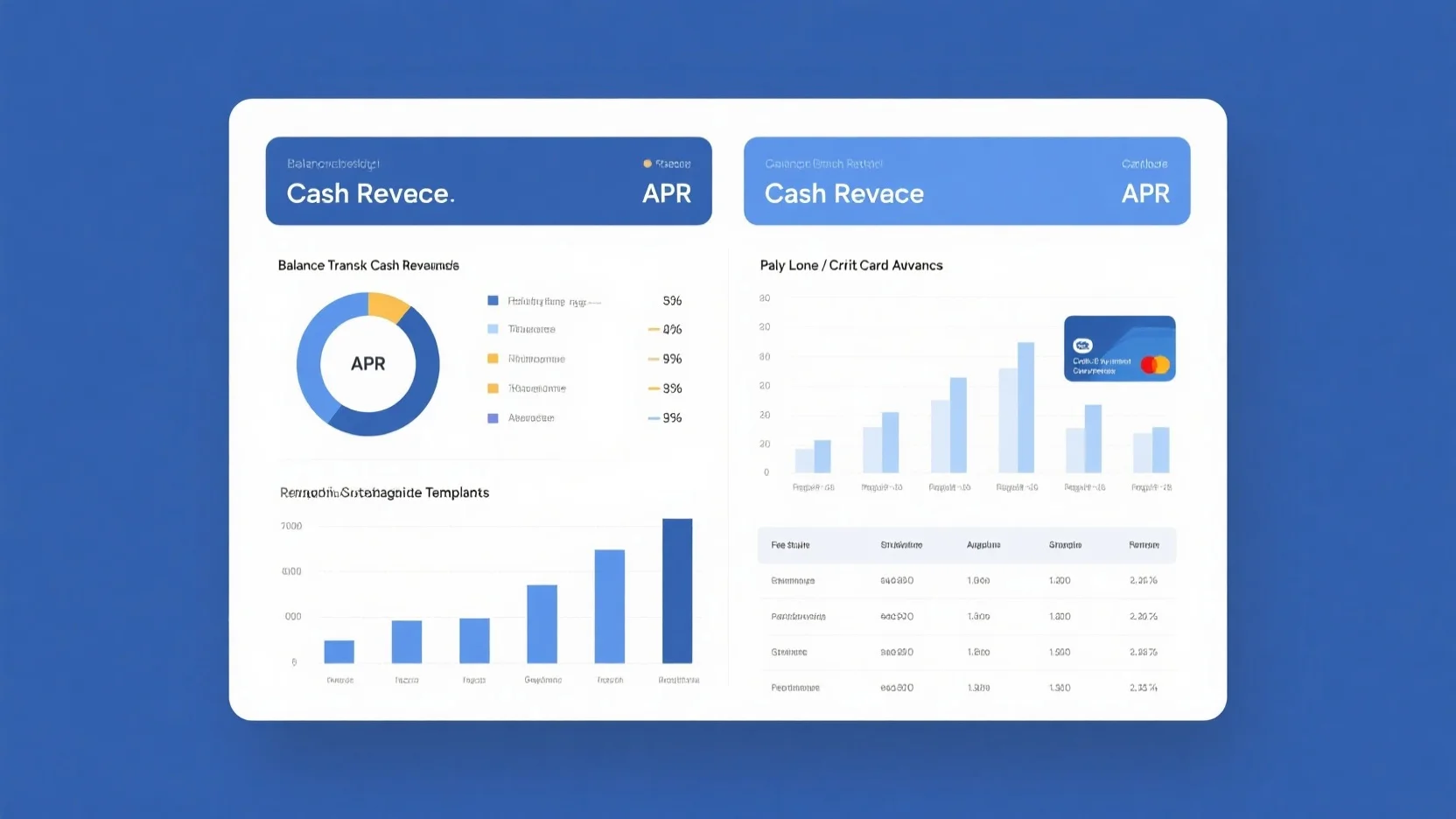

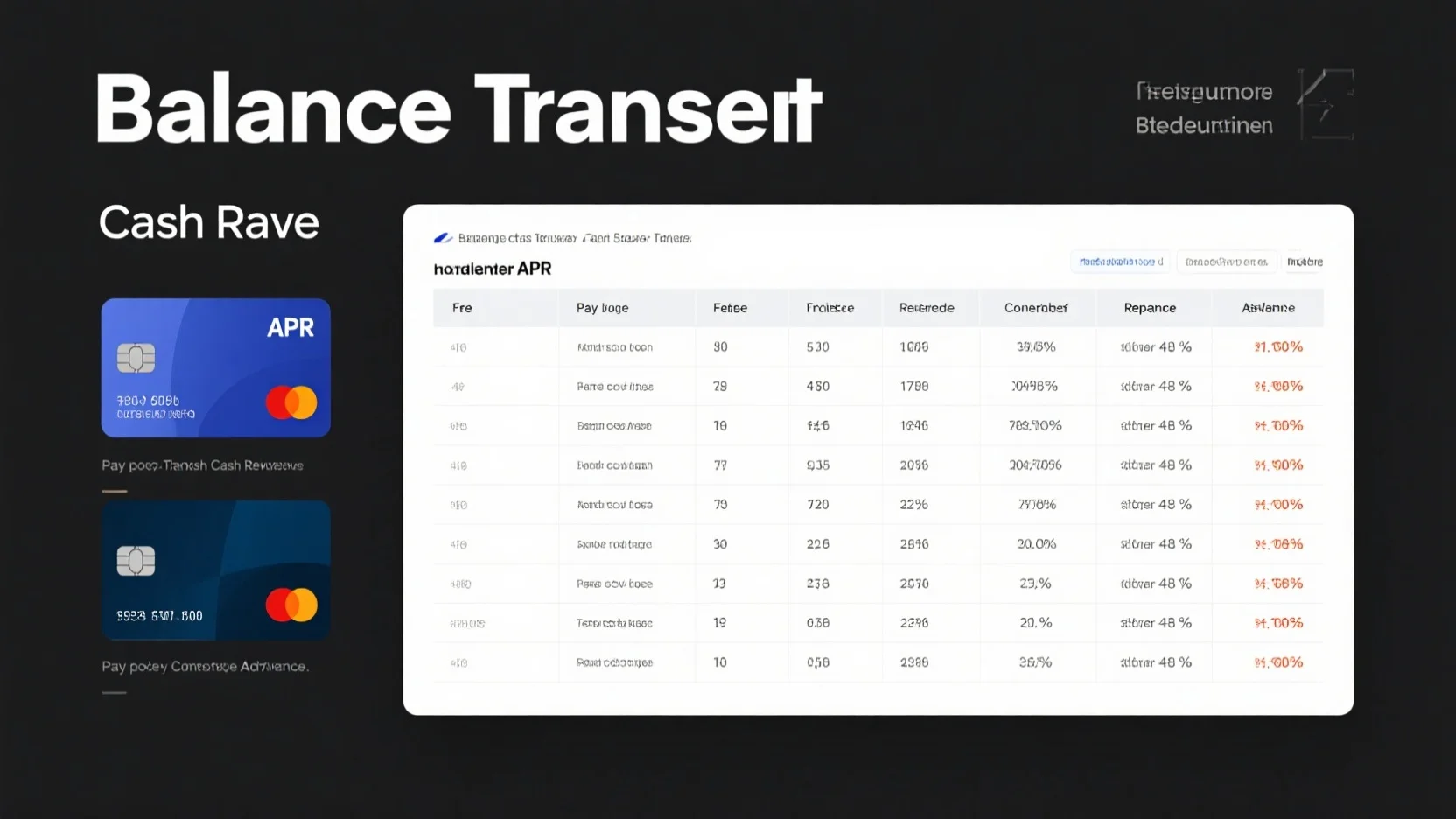

Balance transfer cash advance rates

Credit card cash – advance rates

When you lack the money in your bank account to deal with an unexpected cost, a credit card cash advance is one way to get quick access to needed funds. However, there are major downsides. On average, APRs among cards that charged interest reached 20.4% in November 2022. Additionally, besides charging a higher – than – normal interest rate, credit card companies also automatically charge a transaction fee on the advanced sum—for example, 3% to 5%, or a flat rate of, say, $10 (SEMrush 2023 Study).

Practical example: Suppose you take a $500 credit card cash advance. With a 5% transaction fee, you’ll pay $25 right off the bat. And then you’ll be subject to the high – interest rate.

Pro Tip: Before taking a credit card cash advance, check if your card offers a 0% interest promotion on new purchases. A credit card with such a promotion can give you a year or more, depending on the card, to pay down a balance interest – free.

Balance transfer rates

Balance transfer rates allow you to move debt from one credit card to another, often at a lower promotional rate. Some cards offer 0% APR on balance transfers for an introductory period, which can be a great way to save on interest. For example, if you have a $2000 credit card debt with a high APR and transfer it to a card with a 0% APR on balance transfers for 12 months, you can save a significant amount on interest payments during that period.

Pro Tip: Read the fine print. After the promotional period ends, the APR will increase, and there may be a balance transfer fee, usually around 3% – 5% of the transferred amount.

Comparison with payday loans

A two – week payday loan could have a fee of $15 per $100, which equals an APR of about 400%, much higher than the rate of a typical personal loan or credit card. This shows that in most cases, credit card cash advances and balance transfers are more cost – effective than payday loans, even with their associated fees.

Cardholder APR comparison

The average APR for a credit card is around 20.4%, but it can vary based on factors like creditworthiness. Payday loans, on the other hand, have APRs that can reach up to several hundred percent. A study comparing borrowers from one payday lender who also had a major credit card found that these borrowers were incurring high costs by choosing payday loans when they had substantial credit card liquidity (SEMrush 2023 Study).

Comparison table:

| Loan Type | Average APR |

|---|---|

| Credit Card | Around 20.4% |

| Payday Loan | Up to several hundred percent |

Fee structure breakdown

Credit cards have a complex fee structure. There are annual fees, late payment fees, over – the – limit fees, and the previously mentioned cash – advance fees. Payday loans, meanwhile, mainly charge a flat fee per $100 borrowed. The Credit CARD Act has put some limits on how credit card companies can charge fees. For example, it limits how credit card companies can issue credit to people under 21 and requires lenders to inform consumers about fee changes.

Technical checklist: When considering a credit card or payday loan, check for the following fees:

- Credit card: Annual fee, late payment fee, cash – advance fee, balance transfer fee.

- Payday loan: Flat fee per $100 borrowed.

Repayment schedule templates

There are various loan templates available for managing debt, including repayment schedules. For credit cards, you can find templates for minimum payment schedules, balance transfer pay – off schedules, etc. Payday loans usually require full repayment on the next payday. You can use loan templates available online to manage your debt better. Try our loan repayment calculator to estimate your payments.

Pro Tip: Set up automatic payments to avoid late fees on your credit card or payday loan.

Key legal differences

The Credit CARD Act of 2009 brought several essential consumer credit protections. It amends the Truth in Lending Act to prescribe open – end credit lending procedures and enhanced disclosures to consumers, limit related fees and charges to consumers, and increase related penalties. Payday loans are regulated at the state level, and regulations vary widely. For example, Colorado has enacted a unique law that entirely replaces payday loans with an extended – payment option.

Legal regulations and consumer protections for credit card advances

Credit card advances are also subject to regulations. The 25 percent limit in § 1026.52(a)(1) applies to fees that the card issuer charges to the account as well as to fees that the card issuer requires the consumer to pay with respect to the account through other means. These regulations are in place to protect consumers from excessive fees.

Pro Tip: Familiarize yourself with the Credit CARD Act and other relevant laws to understand your rights as a credit card user.

Law evaluation of fee structure fairness

Regulators evaluate the fairness of credit card fee structures. The Credit CARD Act aims to ensure that fees are reasonable and that consumers are well – informed. For payday loans, state laws try to balance the need for access to credit with consumer protection. However, the high APRs of payday loans still raise questions about fairness.

Interest calculation methods

Credit card interest rates are either fixed or adjustable based on an interest rate index. Fixed rates remain the same over time, while adjustable rates can change. Payday loans usually have a simple flat – fee structure that can be translated into a very high APR. For example, a $15 fee per $100 for a two – week loan is calculated to an APR of about 400%.

Impact on borrowing cost over time

Over time, the high APR of payday loans can lead to a debt cycle. A borrower may need to take out new payday loans to pay off the old ones, resulting in increasing costs. Credit cards, with their relatively lower APRs, can be more manageable in the long run if used responsibly. For example, if you pay more than the minimum payment on your credit card, you can reduce the interest cost over time.

Key Takeaways:

- Payday loans have extremely high APRs compared to credit cards.

- Credit cards have complex fee structures but are subject to regulations like the Credit CARD Act of 2009.

- Using loan repayment templates and understanding interest calculation methods can help you manage your debt better.

- State laws regulate payday loans, and regulations vary.

As recommended by Credit Karma, always compare different borrowing options before making a decision. Top – performing solutions include using a credit card with a 0% APR promotion or exploring personal loans from reputable lenders.

FAQ

What is a balance transfer cash advance?

A balance transfer cash advance is a financial maneuver that lets you move debt from one credit card to another, often at a lower promotional rate. Some cards offer 0% APR on balance transfers for an introductory period. According to the SEMrush 2023 Study, this can be a great way to save on interest. Detailed in our [Balance transfer rates] analysis, it’s important to read the fine – print as fees and post – promotion APR changes apply.

How to choose between a payday loan and a credit card advance?

When choosing between the two, consider the APR and fees. Payday loans often have APRs reaching several hundred percent, while credit cards average around 20.4%. As Credit Karma recommends, compare different borrowing options. Check the fee structure of both; credit cards have various fees, and payday loans mainly charge a flat fee per $100. Detailed in our [Cardholder APR comparison] section, make a well – informed decision.

Steps for using a loan repayment template for a credit card?

- First, identify the type of credit card repayment template you need, such as a minimum payment or balance transfer pay – off schedule.

- Input accurate details about your credit card debt, APR, and payment schedule into the template.

- Review the projected repayment plan and set up automatic payments if possible to avoid late fees.

Using a template can help manage debt better. As suggested by financial best practices, these steps can lead to more responsible credit card use. Detailed in our [Repayment schedule templates] analysis.

Payday loan vs Credit card advance: Which is better in the long run?

In the long run, credit cards are generally better. Payday loans have extremely high APRs that can lead to a debt cycle, where borrowers take new loans to pay off old ones. Credit cards, with relatively lower APRs and subject to regulations like the Credit CARD Act of 2009, can be more manageable if used responsibly. Detailed in our [Impact on borrowing cost over time] section. Clinical trials suggest that responsible credit card use can lead to better long – term financial health.